UNPRECEDENTED CUSTOMER SERVICING

Banks often face challenges with outdated IT architectures, limiting timely access to essential customer information. This hinders the customer service team from providing a seamless experience, leading to increased customer churn and bank employee de-motivation.

Axxiome Digital solves these issues, and empowers customer representatives with instant access to all essential information, seamlessly integrating data from any relevant sources.

Key Features

Axxiome Digital offers bank employees a flawless user experience, blending advanced technology with user-centric design. By boosting efficiency, it allows representatives to prioritize customer engagement and strategic advice. Moreover, its omni-channel features promote customer self-service and further reduce operational efforts.

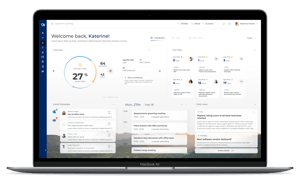

CENTRAL DASHBOARD

Central entrypoint for bank employees to run daily servicing and operations. Utilizing widgets, the portal can be flexibly configured on bank-wide and personal level. Some of the features available:

- Task Management

- Goals and KPI Achievements

- Bank News and Communications

- Mail and Calendar

- Global customer search

- Access to other banking modules

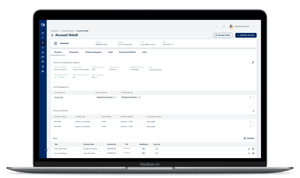

CUSTOMER 360 VIEW

Axxiome Digital provides a unified customer view for both retail and commercial customers by seamlessly integrating all backend systems: CRM, Core Banking applications, Card Management, Payment Hub, and third-party solutions. Here are a few examples of the information provided:

- Customer master data and relationships

- Addresses, correspondence, signatures and IDs

- KYC / KYB information

- Accounts, cards and transactions

- Full financial position

- Customer interactions and insights

CORPORATE CUSTOMER VIEW

Specifically for corporate customers, aggregated information based on company hierarchies or geographies is provided. This extends the standard customer 360 view, and includes:

- Company relationships

- Aggregated financial position

- Company drill-down

- User and roles management

SERVICE OPERATIONS

Optimize and automate operations. The omnichannel capabilities facilitate seamless process transitions across employee and customer channels, fostering digital collaboration and customer satisfaction. Some of the operations processes are:

- Customer master data and relationship maintenance

- Accounts and cards maintenance

- Management of customer and account locks

- Payment initiation and management of recurring payment instructions

OTHER CAPABILITIES

Gain deep insights into customer interactions, enabling banks to make informed, real-time decisions on customer behaviour.

Benefits

- Increase Employee Satisfaction: Intuitive, modern user experience simplifies bank operations.

- Enhance Employee Productivity: Unified user experience combined with high process automation reduces lead times.

- Reduce Training efforts: Complex workflows are streamlined and provide proper guidance.

- Improve Data Quality: Common guided processes reduce risk of incorrect data inputs.

- Gain Customer Insights: Central view of all data provides unprecedented understanding of your customers.

- Boost Revenues: Targeted up- and cross-selling based on customer insights.

- Increase Customer Satisfaction: Streamlined processes and operations improve response times.

- Reduce Cost: Increased efficiencies and customer self-service enablement reduce overall servicing efforts.

FREQUENTLY ASKED QUESTIONS

Certainly, Axxiome Digital enables different systems and applications to communicate with each other in real-time and allows seamless data transmission, data retrieval and transactions.

No. Data duplication and related problems are avoided as operations are carried out in directly connected core banking systems.

When integrating into complex architectures with multiple data sources, we utilize a Data Virtualization tool to cache data, ensuring real-time availability and optimal performance in Axxiome Digital.

Axxiome Digital offers multiple deployment options, including on-premise, self-hostsed and cloud deployments. Read more about the Digital Platform and Deployment Options.

Our platform employs multi-layered security, including end-to-end encryption, two-factor authentication, and regular security audits to safeguard sensitive financial information.

RELATED RESOURCES