OMNICHANNEL

AT ITS HEART

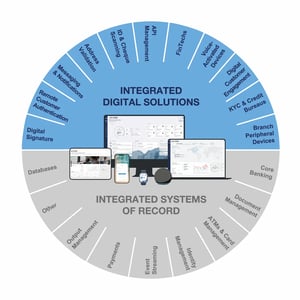

In our digital banking platform, omni-channel isn't just a feature, it's the foundation. The user experience translates seamlessly across devices, ensuring your financial journey is fluid and intuitive. Our robust identity and access management safeguards every transaction. Dive deeper, and you'll find a sophisticated backbone of business process management, interacting with domain-based macro-services. Utilizing event streaming, every update is real-time. And with our integration capabilities, our platform not only adapts to today's digital demands but is primed for the future.

Key Features

Explore our digital platform's key features: a fusion of user-centric design, advanced security, and cutting-edge technology capabilities.

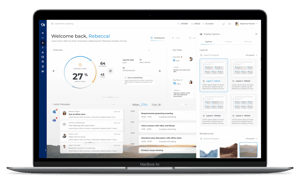

USER EXPERIENCE

Experience a modern UI framework tailored for both bank employees and customers, seamlessly addressing their unique needs and enhancing banking interactions.

- Dashboards with flexible widgets

- Advanced search and filtering

- User-defined Views

- Collaboration and Notifications

- Role-based Permissions

- Multi-Language Support

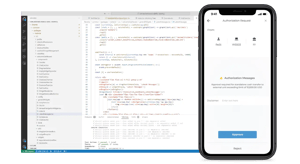

IDENTITY, ACCESS & APIS

Secure identity and access management ensures distinct separation between internal bank employees and external customers, safeguarding every interaction.

- Centralized, secure API access and authentication.

- Efficiently design and manage APIs

- Provide banking industry standard APIs for Fintechs, Partners and Consumers

- Securely route requests to business services

- Track usage metrics and provide performance and analytics insights

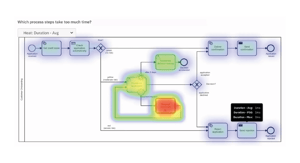

BUSINESS PROCESS STUDIO

The heart of our platform is a visual business process studio: BPMN-2 compliant, centralizing design, orchestration, and monitoring of all banking business processes.

- Out-of-the-box banking processes

- Visual Process Modeling using an intuitive interface

- Powerful Process Engine to automate, execute and monitor business processes

- Business Rules and Decisions to define business logic efficiently

- Integrated Task Management

- Advanced Error Handling and Compensation Logic

- Real-time Process Monitoring with analytics and reporting

BUSINESS SERVICES

Robust, adaptable banking macro-services designed to efficiently support expansive banking operations, ensuring optimal performance and seamless operations.

- Modular Java Banking Microservices to develop, deploy, and scale individual banking functions independently

- Easily extendable to adapt to evolving banking needs

- Flexible Scalability ensuring optimal resource allocation and performance during peak transaction periods

- Enhanced Resilience to ensure continuous operations and minimize outages

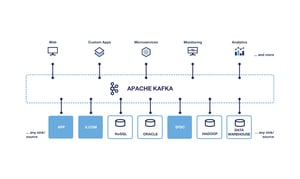

EVENT STREAMING

Our event streaming capabilities enable real-time data flow and ensure system components interact without direct dependencies, promoting flexibility and rapid adaptability.

- Real-time data processing, notifications and analytics

- Seamless integration across disparate systems

- Scalability to handle massive data volumes

- Facilitates decoupled, resilient architectural designs

INTEGRATION ADAPTER

Our integration adapter bridges diverse platforms, enabling multi-core coherence, ensuring universal connectivity, and simplifying third-party solution integrations.

- Integration of disparate systems for seamless interoperability

- Supports high-performance multi-core integrations

- Simplifies third-party solution connectivity

- Ensures data consistency across platforms

- Maps external data structures to internal data model

OTHER CAPABILITIES

Benefits

- Innovation Focus: Prioritize strategic innovation over platform intricacies.

- Time Efficiency: Accelerate digital transition, bypassing lengthy development cycles.

- Cost Savings: Eliminate high developmental costs and overheads.

- Proven Reliability: Tested platform reduces operational risks.

- Continuous Updates: Get regular enhancements without developmental burden.

- Scalability: Designed for growth, handling increased loads effortlessly.

- Expert Support: Access specialists for troubleshooting and training.

- Regulatory Compliance: Built with banking regulations in mind.

FREQUENTLY ASKED QUESTIONS

RELATED RESOURCES