EMERGE BEYOND LEGACY LIMITATIONS

As Open Banking becomes a reality in various countries and with the prospect of PSD3 on the horizon, banks are now presented with a prime opportunity to explore the potential of Open Banking. Establishments that foster partner collaborations are better equipped to handle future uncertainties. Yet, several banks find themselves hindered by outdated legacy systems, often decades old, which have limited their adaptability and prevented them from fully embracing the evolving Open Banking landscape.

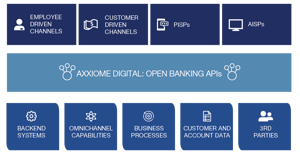

Axxiome Digital empowers banks to unlock their architecture, tapping into the advantages of Open Banking while delivering an authentic OmniChannel Experience to bank employees, customers and ecosystem partners.

Key Features

Axxiome Digital transforms financial institutions into customer-centric, future-ready enterprises. The platform offers omni-channel solutions, APIs, UIs, out-of-the-box processes, and digital widgets for superior experiences and seamless operations across devices, channels, and Fintechs / Partners of the bank's ecosystem.

OPEN BANKING STANDARDS

Global standards are pivotal for fostering a seamless financial ecosystem. They promote interoperability, ensure robust data security, and mandate consumer protection, creating a harmonized framework across countries. Axxiome Digital can be configured to support:

- Payment Services Directive (PSD2 / soon PSD3) in Europe

- Open Banking Implementation Entity (OBIE) Standards in UK

- Financial Data Exchange (FDX) in North America

- Consumer Data Right (CDR)in Australia

- OpenID Connect & Financial-grade API (FAPI)

- and more...

AGNOSTIC ARCHITECTURE

Axxiome Digital’s omni-channel capabilities provide a unique opportunity for banks to implement all their business processes and functions centrally. Allowing Fintechs, Partners, Mobile and Online Banking solutions as well as employee channels to consume the same capabilities including:

- Financial Products & Services

- Payment Transactions

- Customer Data

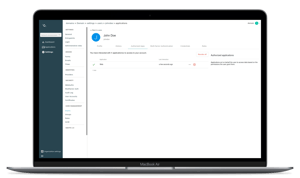

CONSENT MANAGEMENT

Open banking consent management ensures customers' control over their financial data, granting, reviewing, or revoking third-party access, prioritizing transparency, security, and regulatory compliance in data-sharing practices. Our solutions encompass:

- User-Friendly Interface to manage consent

- Granular Consent Options to define data access levels

- Real-Time Revocation to instantly withdraw third-party access

- Transparent Audit trails to track consent histories

- Multi-Factor Authentication to secure consent actions

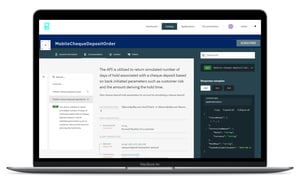

DEVELOPER PORTAL

Open banking sandbox environments offer developers a testing ground to experiment with bank APIs without real data. Developer portals provide tools, resources, and documentation to guide integration and ensure compliance. Axxiome Digital supports the following features:

- Comprehensive API documentation and guides

- Interactive API endpoints for hands-on experience

- Feedback mechanisms for developer queries

- Robust security measures for safe experimentation

- Realistic, anonymized data for testing

OTHER CAPABILITIES

Visual business process studio centralizing design, orchestration, and monitoring of all banking business processes.

Benefits

- Enhanced Customer Experience: Personalized, innovative services tailored to individual needs.

- Increased Revenue Streams: New products, services, and partnership opportunities.

- Improved Decision Making: Enhanced data access aids in informed strategies.

- Operational Efficiency: Streamlined processes through API integrations.

- Market Expansion: Reach broader customer segments via third-party platforms.

- Risk Reduction: Better data sharing can improve credit decisions.

- Secure Investments: Unlocks Open Banking advantages while utilizing existing legacy systems.

- Fostering Innovation: Collaborations with fintechs drive technological advancements.

FREQUENTLY ASKED QUESTIONS

RELATED RESOURCES