DESIGNED TO MAKE BANKS READY FOR THE FUTURE

Our digital platform stands at the forefront of modern financial technology. It is specifically designed to manage core diversification, guide smooth migrations, and ensure efficient mergers & acquisitions. Key to your success is its ability to execute these complex operations without any disruptions, ensuring both employee and customer experiences remain consistent and satisfying. This architecture is not just a solution for today; it's a robust foundation built for the evolving challenges of tomorrow's banking landscape.

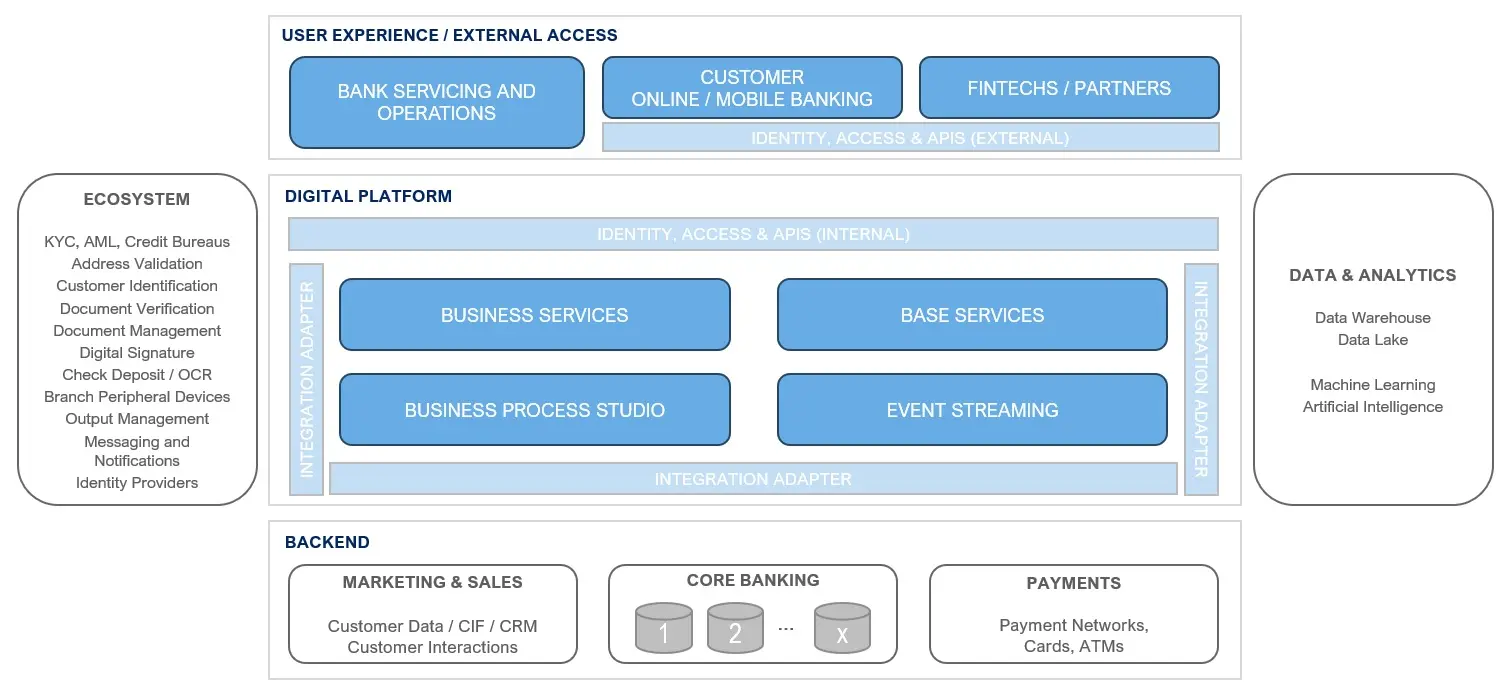

Architecture Blueprint

The foundational principles of our digital platform emphasize core independence and a core-agnostic approach. Centralized process governance, coupled with the abstraction of connected solutions, ensures consistent experiences for both employees and customers. Embracing flexibility, our blueprint seamlessly integrates third-party solutions. Through event streaming, we ensure real-time integrations and continuous data flows across the entire architecture. Read more about the individual architecture components of the Digital Banking Platform.

Use Cases

Explore diverse scenarios demonstrating our platform's adaptability and effectiveness in real-world banking challenges.

CORE DIVERSIFICATION

Harnessing multiple core systems allows for specialization in distinct banking domains without needing a complete system overhaul. By reducing dependence on single core providers, banks diminish vendor lock-in risks and can benefit from a best-of-breed strategy. The outcome is enhanced operational autonomy, tailored customer offerings, and a platform optimized for forward-thinking innovation.

MERGERS & ACQUISITIONS

Multi-core capabilities ensure a smooth integration of varied banking systems during mergers or acquisitions. Operational synergies are realized as employees transition swiftly to a common user experience. Similarly, customers can be migrated seamlessly to unified applications, ensuring consistency and reducing friction.

LEGACY SYSTEM MODERNIZATION

Gradual transition from outdated systems to contemporary architectures means continuous, uninterrupted operations. This reduces the inherent risks of wholesale migrations, preserves vital data, and ensures a phased approach to adopting the latest banking tech, balancing innovation and reliability.

Benefits

- Core Specialization: Adopt best-of-breed core systems that are specifically designed to excel in targeted functional areas.

- Unified Employee Experience: Equip your bank employees with modern, intuitive UIs that offer a consistent experience.

- Customer Centricity: Deliver a superior customer experience through unified channels of interaction and support.

- Provider Independence: Decrease reliance on a single core provider to enhance system resilience and flexibility.

- M&A Integration: Simplify and expedite the technological integration processes involved in mergers and acquisitions.

- Legacy Modernzization: Smooth transition from older systems to modern platforms, reducing costs and minimizing risk.

- Agile Development: Speed up the development and deployment of new products and services.

- Operational Autonomy: Improve operational freedom by optimizing processes and workflows in a core-agnostic way.

FREQUENTLY ASKED QUESTIONS

RELATED RESOURCES